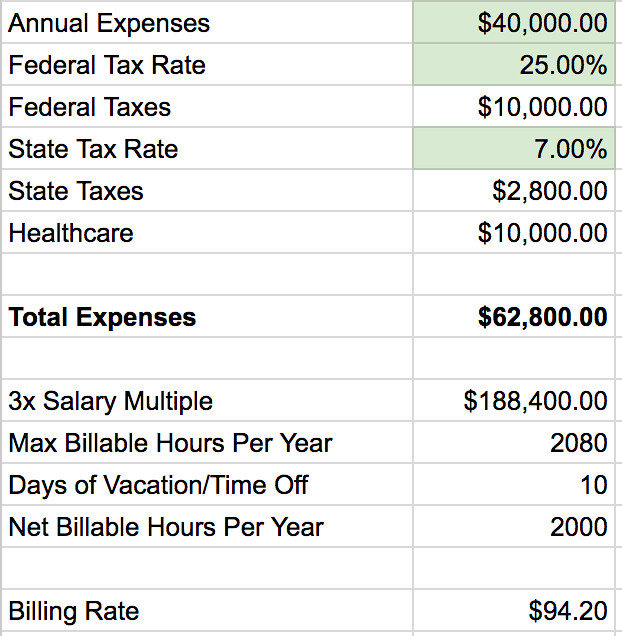

This means you'll probably have only 1,300 to 1,500 hours for which you can get paid each year, if you still want that two-week vacation. However, you'll probably spend at least 25% to 35% of your time on tasks that you can't bill to clients, such as bookkeeping and billing, drumming up business, and upgrading your skills. If you want to take a longer vacation, you'll have fewer billable hours. If you want to take a two-week vacation each year, you'll have a maximum of 2,000 billable hours per year (50 weeks x 40 hours). Assume you'll work a 40-hour week for purposes of this calculation, although you may end up working more than this. Finally, you need to determine how many hours you'll work and get paid for during the year. There is no standard profit percentage, but a 10% to 20% profit is common.ĭetermine billable hours. Profit is usually expressed as a percentage of total costs. It also provides money to expand and develop your business. Profit is the reward you get for taking the risks of being in business for yourself. Your salary does not count as profit it's one of the costs of doing business. You're also entitled to earn a profit over and above your salary and overhead expenses. If you're just starting out, you'll have to estimate these expenses or ask other ICs in the same field what they pay in overhead, then use that amount in your calculations.Ĭhoose a profit margin. Overhead also includes the cost of your fringe benefits, such as medical insurance, disability insurance, and retirement benefits, as well as your income taxes and self-employment taxes.

To determine how much your labor is worth, pick a figure for your annual salary. Depending on market conditions, you may be able to charge more for your services - or you might have to get by on less.ĭetermine your annual salary. This is the minimum you must charge to pay your expenses, pay yourself a salary, and earn a profit. Investigate the marketplace to see if you should adjust your rate up or down.īusiness schools teach a standard formula for determining an hourly rate: Add up your labor and overhead costs, add the profit you want to earn, then divide the total by your hours worked.Calculate what your rate should be, based on your expenses.If you're in this boat, try using a two-step approach to determine your hourly rate: However, if you're just starting out, you may have no idea what you can or should charge.

If you're experienced in your field, you probably already know what to charge because you are familiar with market conditions. You can't determine how much your fixed fee should be unless you know roughly how many hours the job will take and what you need to earn per hour to make it worth your while. No matter how you bill clients, however, you first need to figure out how much to charge - even if you charge a fixed fee for the whole project. Independent contractors (ICs) can charge for their services in a variety of ways, such as a fixed amount for an entire project, an hourly fee, or a sales commission.

0 kommentar(er)

0 kommentar(er)